Tax season can be a stressful time for many, but as a healthcare provider, you have the unique opportunity to make it a healthy one. By utilizing IRS templates specifically designed for healthcare professionals, you can streamline your financial processes and ensure that you are maximizing your deductions. In this article, we will explore how these templates can serve as a prescription for financial health during tax season.

Tax Season Wellness: IRS Templates for Healthcare Providers

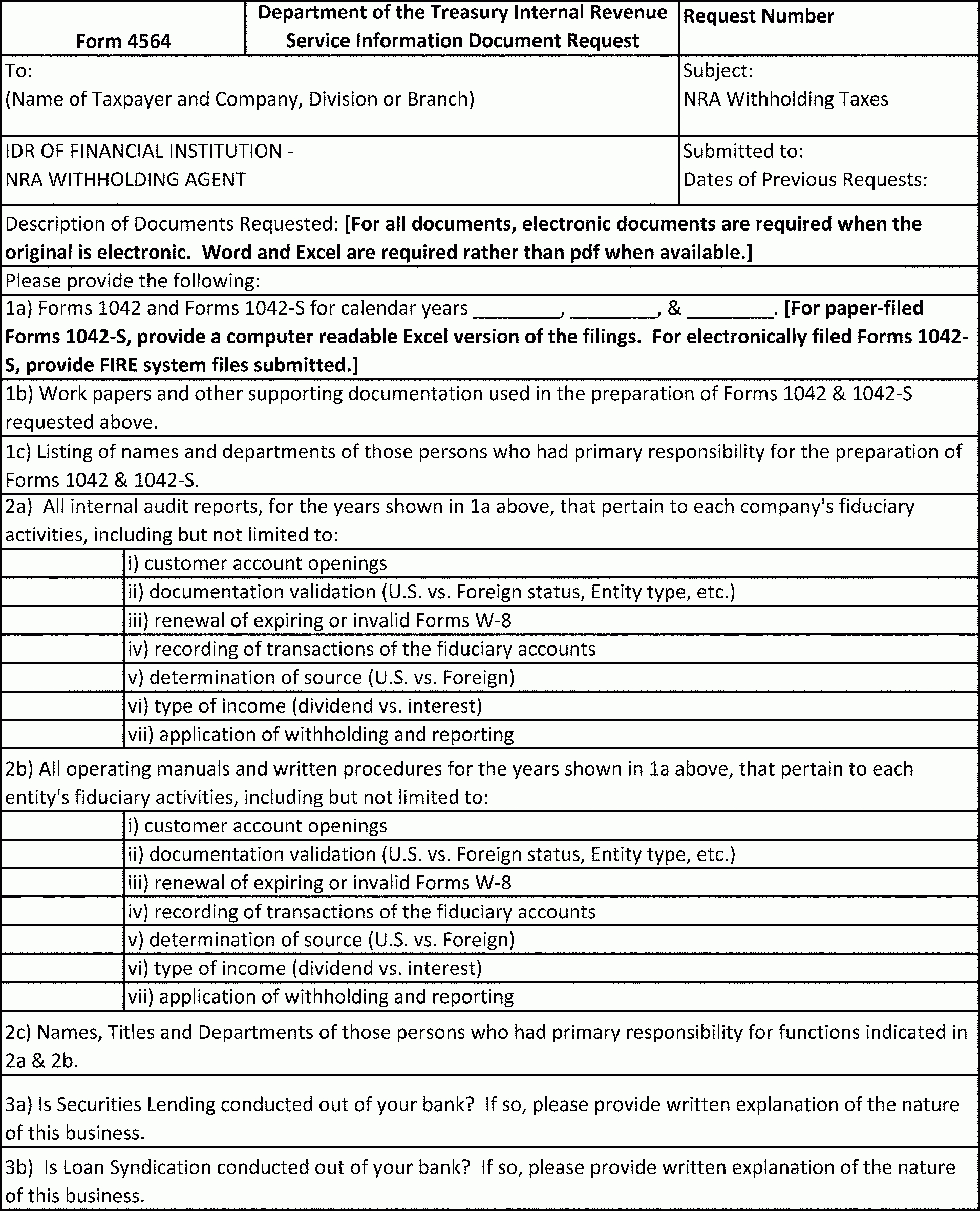

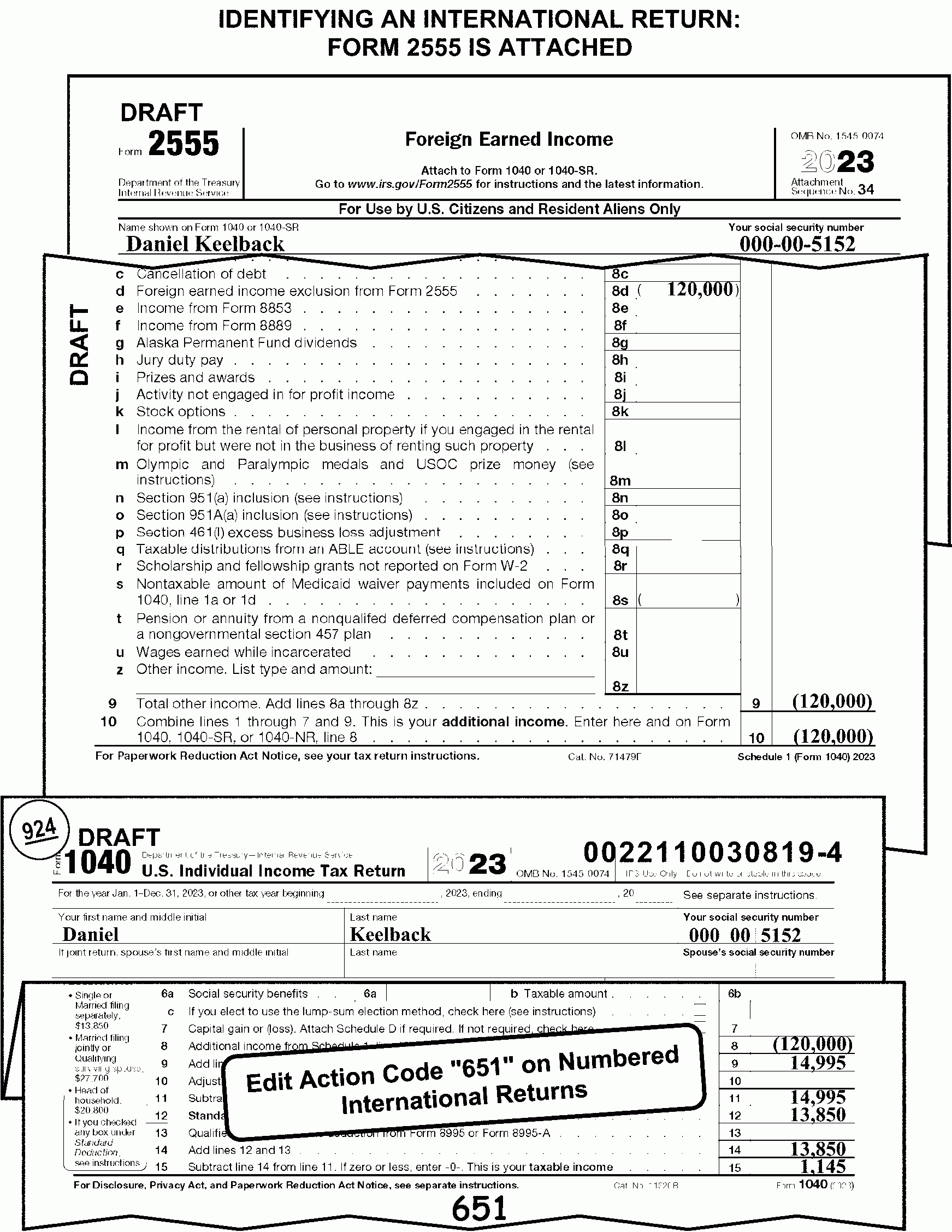

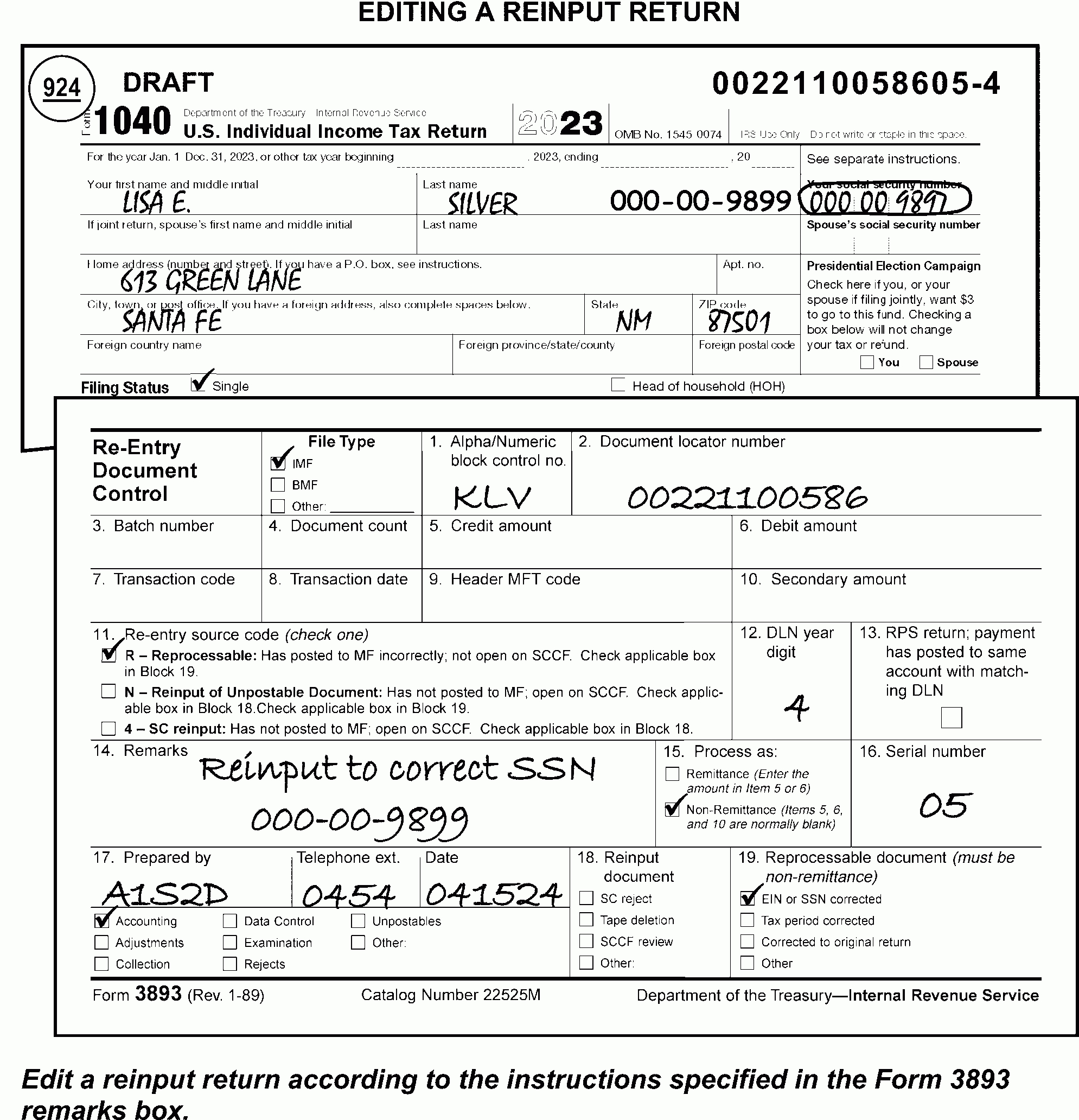

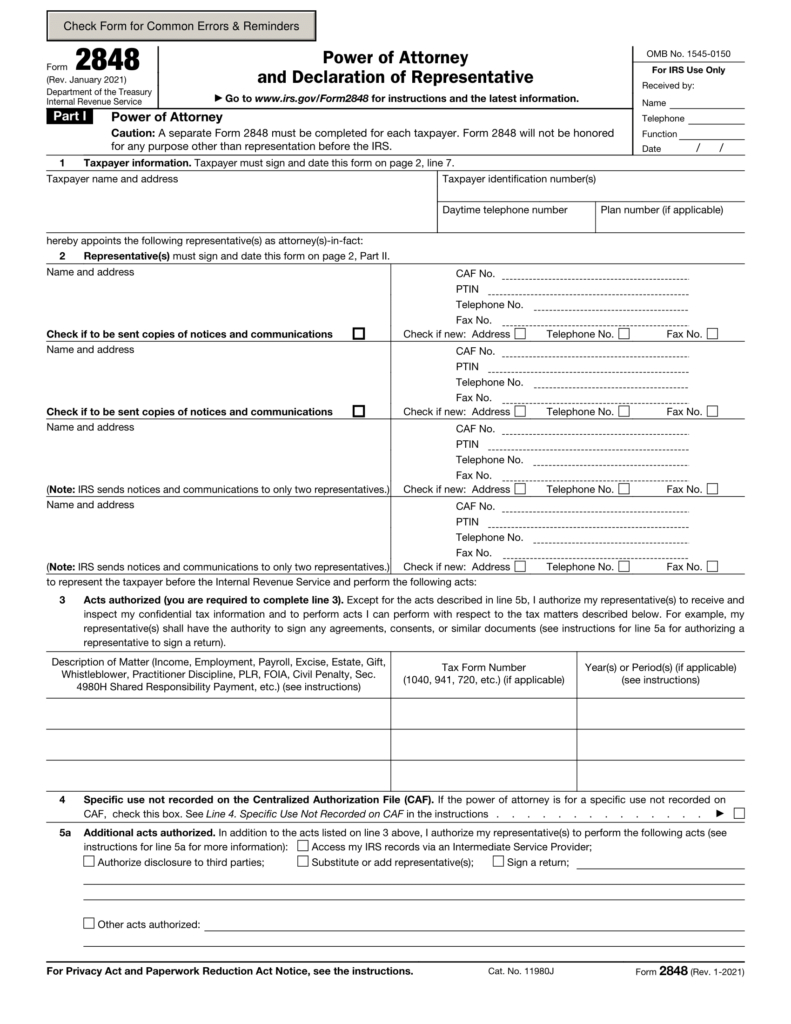

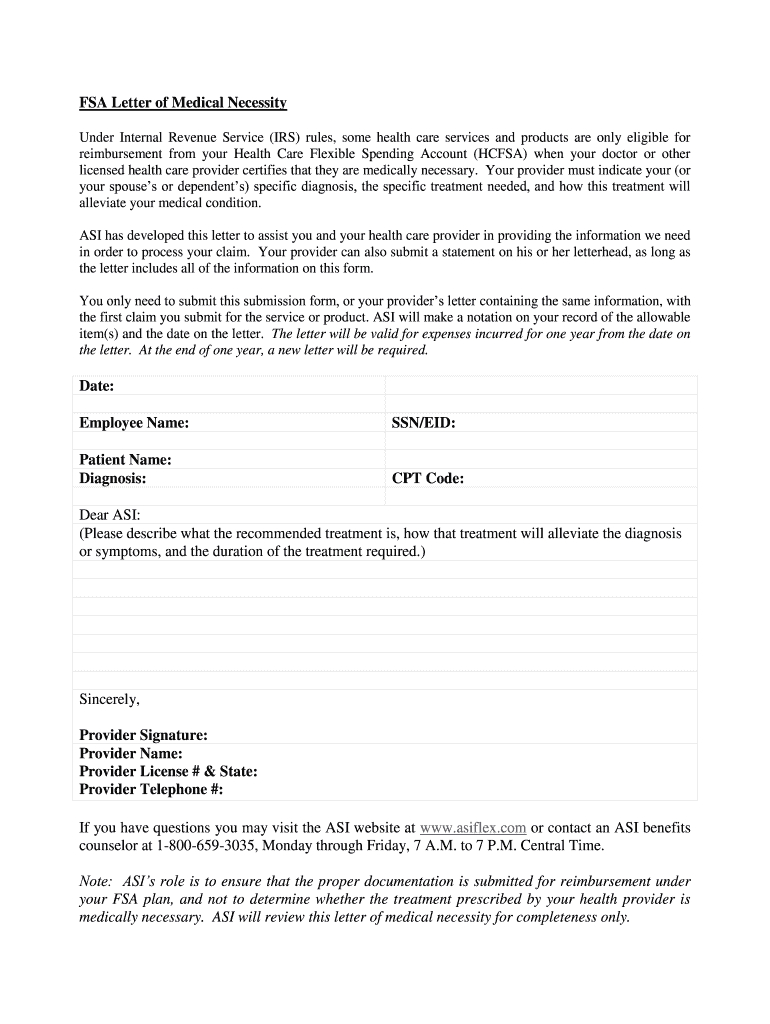

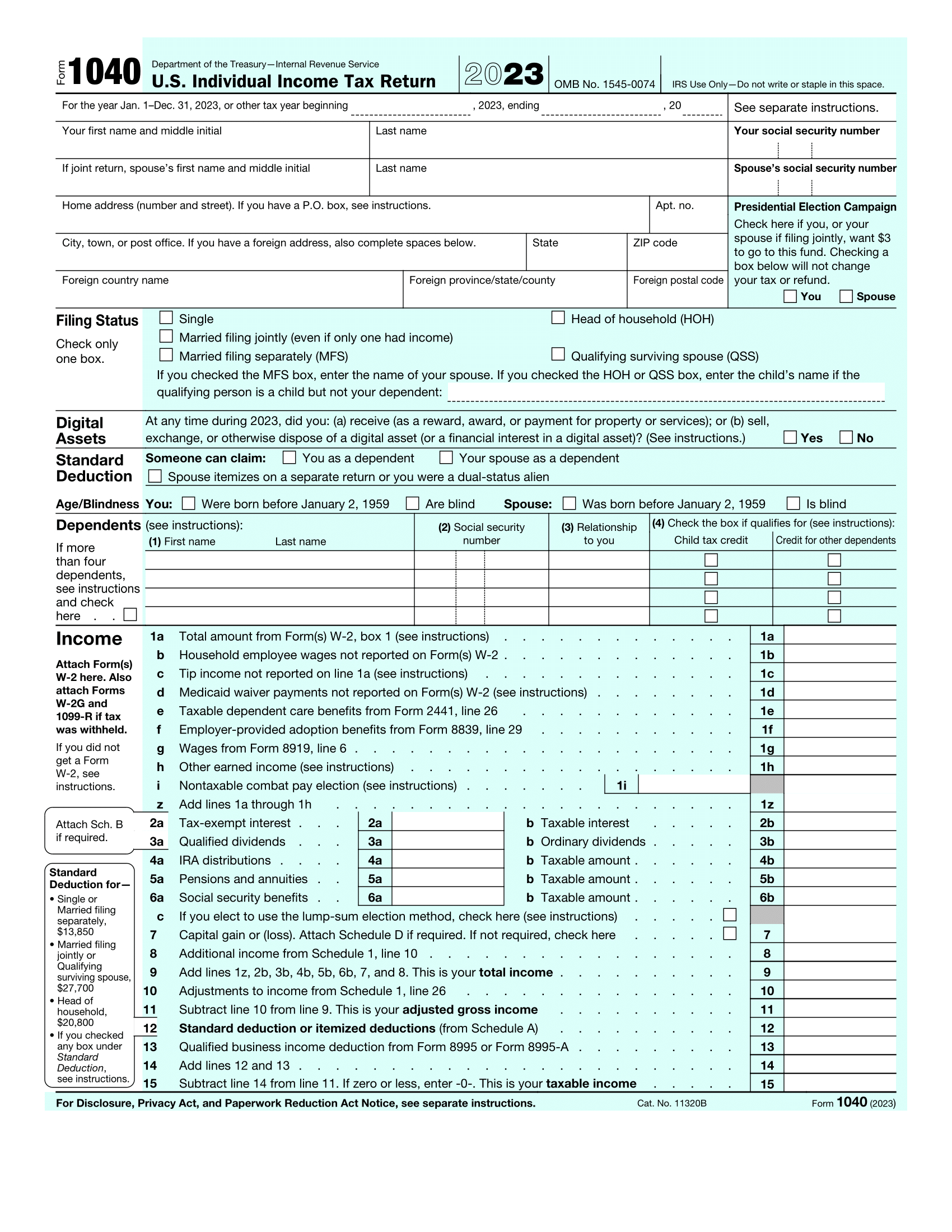

As a healthcare provider, you have a lot on your plate – caring for patients, managing your practice, and now, navigating tax season. The good news is that the IRS provides templates tailored to the unique needs of healthcare professionals. From reporting your income to deducting expenses related to your practice, these templates can help simplify the tax filing process and ensure that you are compliant with all regulations. By utilizing these templates, you can focus on what you do best – providing quality care to your patients.

Tax season wellness is not just about getting your taxes done on time, it’s also about ensuring that you are maximizing your deductions and optimizing your financial health. The IRS templates for healthcare providers can help you do just that. By keeping accurate records and utilizing these templates, you can identify areas where you may be able to save money and improve your overall financial well-being. So, don’t let tax season stress you out – let the IRS templates be your guide to a healthier financial future.

A Prescription for Financial Health: Your Guide to IRS Forms

Just like a prescription from a doctor can help improve your physical health, IRS templates can serve as a prescription for your financial health. By using these forms, you can ensure that you are fully compliant with all tax regulations and maximize your deductions. Whether you are a sole practitioner or part of a larger healthcare organization, these templates can help streamline your tax filing process and keep your finances in tip-top shape. So, this tax season, don’t forget to take your dose of IRS templates for a healthier financial future.

In conclusion, tax season doesn’t have to be a source of stress and anxiety for healthcare providers. By utilizing IRS templates specifically designed for healthcare professionals, you can take control of your finances and ensure that you are maximizing your deductions. So, take a proactive approach to your financial health this tax season and let the IRS templates be your guide to a healthier bottom line.

More Template Samples…

More Template Samples…

Disclaimer: All images on this website are the property of their respective owners. If you are the owner of an image and do not wish for it to be published on this website, please contact us. Upon receipt of your request, we will promptly remove the image in question.